31+ Charitable Remainder Trust Calculator

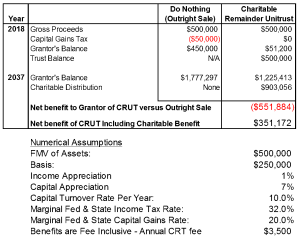

Cash Appreciated Securities Closely Held Stock Real Estate Retirement Plan Assets An Example of How It. Web Charitable Remainder Annuity Trust CRAT With a CRAT beneficiaries receive a fixed annual income that is determined at the time the trust is established.

Greater Kansas City Community Foundation

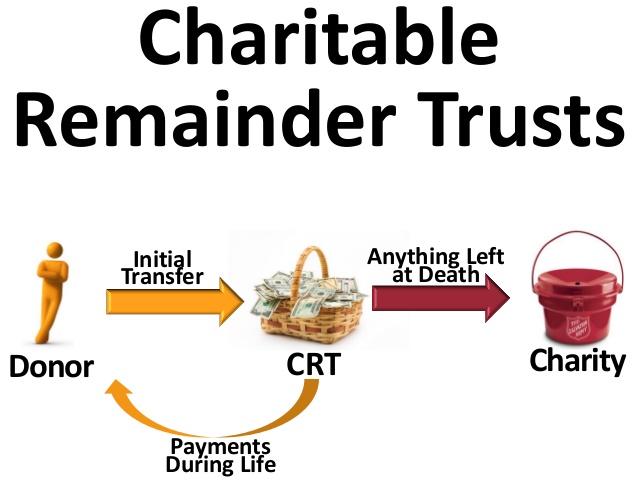

Web Charitable Remainder Trusts are an Estate Planning tool that might allow you to earn income while reducing both income tax now as well as estate taxes after you pass away.

. You pay no taxes when you sell and. Legacy Income Trust. Web The calculator estimates the potential income tax charitable deduction based on the gifts value the expected payments to the individual beneficiary ies and.

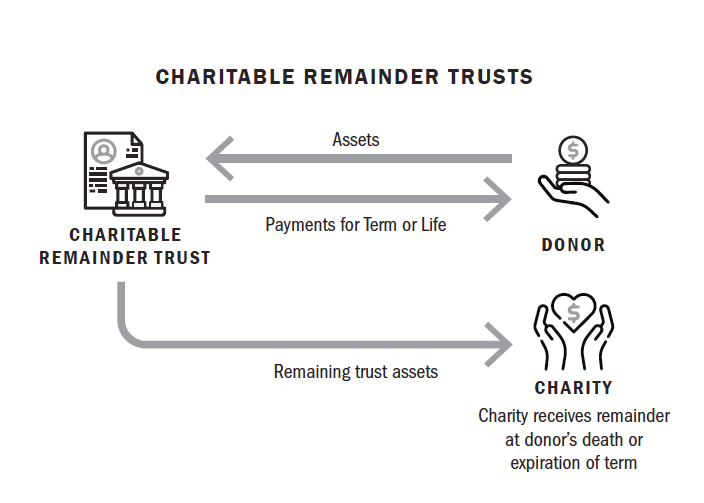

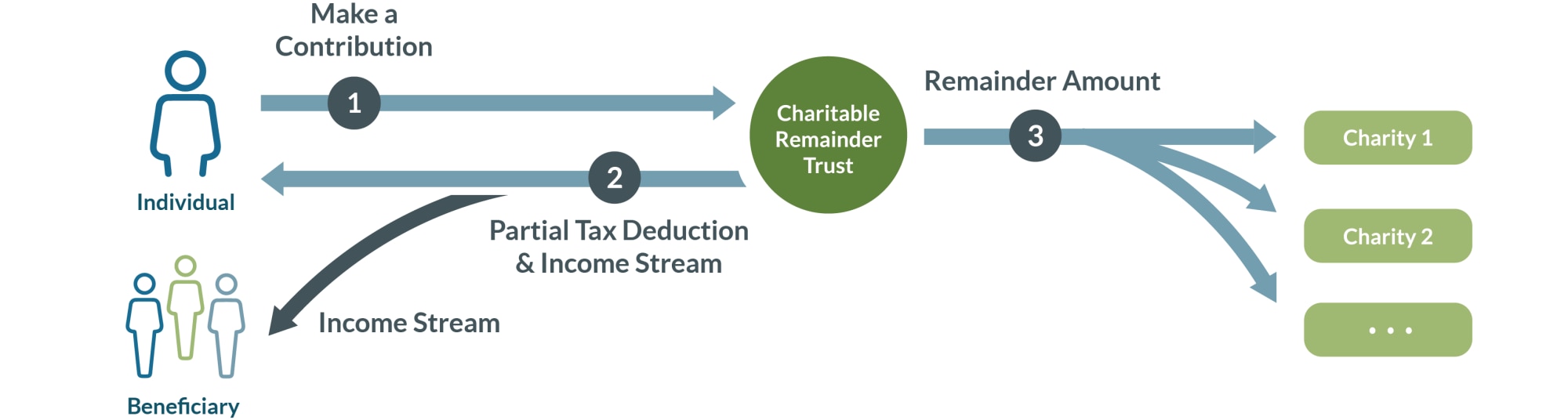

Our Charitable Remainder Trust calculator will help you. Web Charitable remainder trusts are irrevocable trusts that let you donate assets to charity and draw annual income for life or for a specific time period. First the sale of appreciated assets in a CRUT trust is tax-deferred.

Web Charitable Remainder Trust Calculator A Charitable Remainder Trust can protect your capital gains from taxes. Web Charitable remainder trusts are an estate planning tool that can be used to claim tax breaks and set yourself up to receive incomeall while giving money to. Web A Charitable Remainder Unitrust carries three significant tax benefits.

Web What Is A Charitable Remainder Trust. Charitable Lead Annuity Trust. Web You are allowed an annual one-time rollover of up to 50000 to a CRAT a charitable remainder unitrust or an immediate charitable gift annuity.

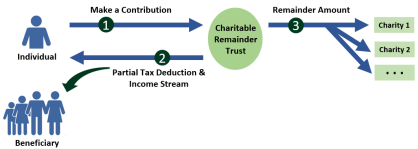

Web Charitable Remainder Annuity Trust. Web The gift calculator below will allow you to test out different charitable remainder trust scenarios. Web Using charitable remainder trusts high-net worth individuals can support their favorite charities and generate an income stream for themselves or another beneficiary.

Web You can use the following assets to fund a charitable remainder trust. Web This calculator indicates the charitable income tax deduction available to Donors making a current contribution to a currently offered US. Web Charitable Remainder Unitrust Calculator.

Web Charitable Remainder Annuity Trust Calculator A great way to make a gift to The FAMiLY Leader receive fixed payments and defer or eliminate capital gains tax. Tax Deferral And Tax-Free Compounding Also Known As More Money 2. Web A charitable remainder trust CRT is an irrevocable trust that generates a potential income stream for you or other beneficiaries with the remainder of the donated assets.

Click on Personalize This Diagram to fill in your gift hypotheticals including. A great way to make a gift to IJ receive payments that may increase over time and defer or eliminate capital gains tax. The Toolkit Calculator is designed to help professionals determine the tax impacts of making various charitable gifts.

Web Charitable remainder trust calculator.

The Jewish Community Foundation Of Montreal

2

Fieldpoint Private

2

Valur Valur Io

Charitable Remainder Trust

Zell Law

Https Www Google Com Search About This Image Img H4siaaaaaaaa Ms4fg25d7j S5lt3uf7rsdptjt041vgqan9tosfgaaaa 3d 3d Q Https Www Irs Gov Pub Irs Soi 10rescon Pdf Ctx Iv

1

Credo Cfos Cpas

Sample Net

Donors Trust

2

Https Www Google Com Search About This Image Img H4siaaaaaaaa Wexaoj Chui0ctdp8ep0mc Emq9nb7nnuar4whg7uedfwaaaa 3d 3d Q Https Assets Publishing Service Gov Uk Media 5a7f1751ed915d74e33f4464 Ofcom Inside Singlepages Hr Updated Pdf Ctx Iv

Fidelity Charitable

Pnc Bank

Baron Law